In today’s subscription-driven economy, Software as a Service (SaaS) companies are transforming how revenue is generated. At first glance, the model looks simple: charge customers monthly or annually for access. But when it comes to accounting, revenue recognition for SaaS is anything but simple.

The key question is: when should revenue be recognized? Do you record it the day you receive the payment, or as you deliver the service month by month? Getting this wrong can distort financial performance, create audit risks, and reduce investor confidence.

This guide explains everything you need to know about SaaS revenue recognition: the rules, the five-step framework, real-world examples, challenges, best practices, and future trends. Whether you are a founder, CFO, or accountant, mastering this concept is critical for compliance and sustainable growth.

What Is Revenue Recognition?

Revenue recognition is an accounting principle that dictates when income should be recorded in financial statements.

- It is not about when you get paid—it is about when you deliver value.

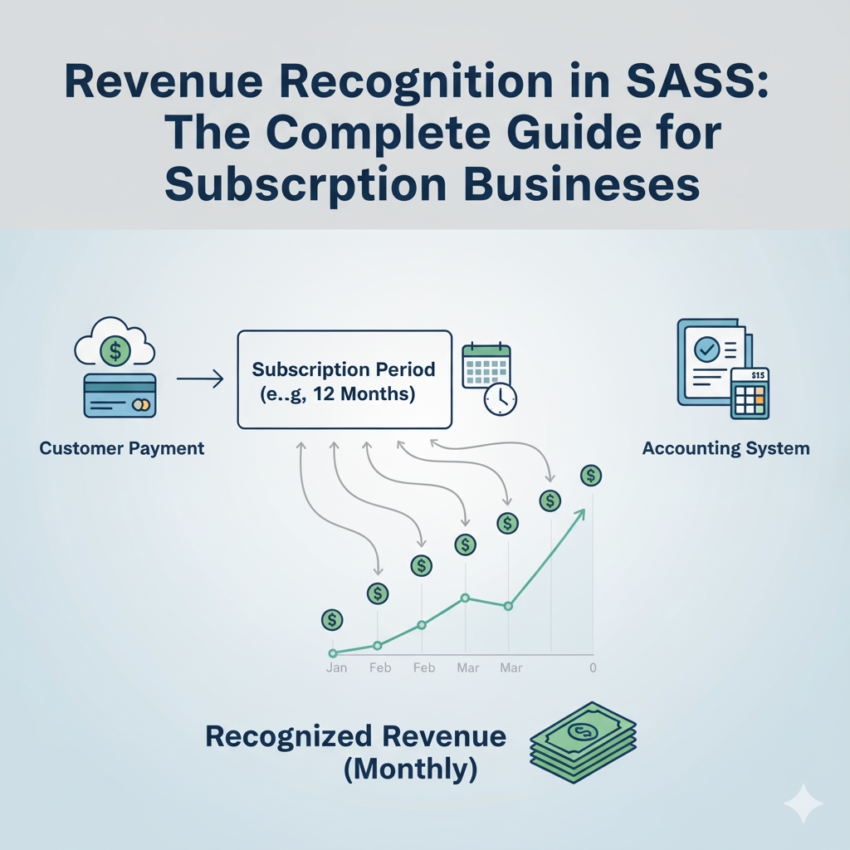

- For SaaS companies, this usually means spreading subscription revenue evenly over the contract term.

Example: If a customer pays $12,000 upfront for a 12-month subscription, you do not recognize all $12,000 in January. Instead, you record $1,000 per month as the service is delivered.

This approach ensures that revenue is aligned with performance, giving a more accurate view of financial health.

The Rules: ASC 606 and IFRS 15

In 2018, new global revenue recognition standards came into effect:

- ASC 606 (US GAAP): Focuses on the transfer of control to the customer.

- IFRS 15 (International): Similar to ASC 606 with small application differences.

Both require SaaS businesses to recognize revenue over time, unless a distinct, one-off service is provided upfront.

Failure to comply is not just a technical issue. It can lead to restated earnings, failed audits, and even legal consequences.

The Five-Step ASC 606 Framework for SaaS

SaaS companies must apply the following framework when recognizing revenue:

- Identify the Contract – Confirm an enforceable agreement including subscription terms and payment details.

- Identify Performance Obligations – Break down deliverables such as software access, updates, support, and setup.

- Determine the Transaction Price – Include fixed fees, discounts, and usage-based pricing.

- Allocate the Transaction Price – Assign value to each obligation (for example, split between setup and subscription).

- Recognize Revenue – Record income as obligations are satisfied, often on a straight-line monthly basis for SaaS.

SaaS Revenue Recognition Scenarios

- Annual Subscriptions Paid Upfront: Recognize revenue evenly across the contract; record unearned amounts as deferred revenue.

- Bundled Offerings: Separate subscription fees from setup fees; recognize setup revenue upfront if it is distinct.

- Usage-Based Billing: Estimate variable revenue conservatively and adjust as actual usage data is received.

- Upgrades and Downgrades: Treat as contract modifications and adjust revenue recognition prospectively.

- Free Trials: No revenue is recognized until a customer converts to a paid plan.

Real-World Examples

- Basic Subscription: $600/month for 12 months, billed annually → recognize $600 per month.

- Bundled Package: $8,000 subscription + $2,000 onboarding → subscription recognized monthly, onboarding upfront.

- Usage-Based Pricing: $500 base fee + $0.10 per API call → base revenue recognized monthly, usage recognized as incurred.

- Contract Modification: Customer upgrades mid-year → adjust remaining recognition prospectively.

Key Challenges in SaaS Revenue Recognition

- Allocating prices within bundled contracts

- Estimating variable usage-based fees

- Frequent contract modifications

- Managing large volumes of customer contracts

- Meeting complex disclosure requirements

- Handling GAAP vs. IFRS nuances for global operations

Because of these challenges, automation and strong accounting systems are essential.

Impact on Financial Statements

- Income Statement: Provides smooth, consistent revenue streams.

- Balance Sheet: Deferred revenue often appears as a liability.

- Cash Flow Statement: Upfront payments create timing mismatches.

- Key Metrics (ARR, MRR): More accurate when recognition rules are applied correctly.

- Investor Confidence: Transparency builds trust and improves valuations.

Best Practices for SaaS Businesses

- Implement automation tools such as Stripe Revenue Recognition, RightRev, or Certinia.

- Ensure contract terms are aligned across sales, finance, and legal teams.

- Regularly review allocations and estimates.

- Provide ongoing training to finance teams to stay current with evolving standards.

Case Studies

- Stripe Example: Improved audit outcomes by applying the five-step model to variable pricing.

- RightRev Implementation: Reduced manual accounting work by 80% and improved MRR accuracy.

- Post-ASC 606 Adoption: Many SaaS companies restated earnings, showing the real-world impact of the new rules.

The Future of SaaS Revenue Recognition

- AI-driven automation will forecast usage and handle recognition.

- ESG and sustainability reporting may become tied to revenue disclosures.

- Global harmonization will reduce differences between US and international rules.

- Hybrid and usage-based pricing models will require more dynamic recognition methods.

- Real-time financial reporting will increasingly become the industry standard.

Conclusion

Revenue recognition is more than compliance—it is about accurately reflecting the value your SaaS company delivers. Applying ASC 606 and IFRS 15, handling bundling and usage-based pricing correctly, and leveraging automation can help ensure accuracy at scale.

When done right, revenue recognition builds trust, supports growth, and protects your company from costly errors.

Need Expert Guidance on SaaS Revenue Recognition?

At SR Financial & Tax Advisors, we specialize in helping SaaS and subscription-based companies:

- Avoid costly compliance mistakes

- Streamline MRR and ARR tracking

- Ensure audit-ready financials

Talk to our experts today and transform the way your SaaS business recognizes revenue.

Contact SR Financial & Tax Advisors now.